UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to §240.14a-12

Berkshire Hills Bancorp, Inc.

| | |

| (Name of Registrant as Specified In Its Charter) |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

☐ Fee paid previously with preliminary materials.

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

| | | | | | | | |

| | | | | | | | April 5, 2024 |

| | April 8, 2022 |

| Dear Berkshire Hills Bancorp Shareholder: |

| |

| It is our pleasure to invite you to attend the 20222024 Annual Meeting of Shareholders, which will be held virtually on Wednesday,Thursday, May 18, 202216, 2024 at 10:00 a.m.a.m, Eastern Time by visitingat our offices at: www.virtualshareholdermeeting.com/BHLB2022, where you will be able to listen to the meeting live, submit questions and vote online. You will be asked to enter the 16-digit control number located on your proxy card.

Berkshire Bank 99 North Street Pittsfield, MA 01201 |

|

|

|

|

|

| |

| CEO, Nitin J. Mhatre | | Please see the Notice of Annual Meeting on the next page for more information about our meeting procedures. |

| |

| | |

| | We urge you to vote your proxy online, or by telephone, or by completing and returning a proxy card by mail as soon as possible, even if you plan to attend the Annual Meeting. |

|

|

|

| |

| Your vote is important to us. Thank you for your attention to the enclosed materials, and for your continued support of our company. |

|

|

| |

| |

| Chairperson, David M. Brunelle | | |

| |

| |

| | Nitin J. Mhatre, Chief Executive Officer |

| | |

| |

| |

| | David M. Brunelle, Chairperson of the Board of Directors |

| | | | | | | | | | | | | | | | | |

| Notice of Annual Meeting of Shareholders | | |

| |

|

|

| |

| Purpose.

Performance.

Progress. |

|

|

| | | | | | | | | | | | | | | | | |

Notice of 20222024 Annual Meeting of Shareholders of Berkshire Hills Bancorp, Inc. |

| When: | | Where: | | Record Date: |

Wednesday,Thursday, May 18, 202216, 2024 | Virtual MeetingBerkshire Bank, 99 North Street | March 25, 202221, 2024 |

| 10:00 a.m. | www.virtualshareholdermeeting.com/BHLB2022Pittsfield, Massachusetts 01201 | |

We are holding this meeting for the following purposes:

1. To elect as directors the nominees named in the Proxy Statement each to serve a one-year term or until their successors are duly elected and qualified;

2. To provide an advisory vote on executive compensation practices;

3.To ratify the appointment of Crowe LLP as the Company’s independent registered public accounting firm for fiscal year 2022;2024; and

4. To approve the Berkshire Hills Bancorp, Inc. 2022 Equity Incentive Plan;

5. To transact any other Company business that may properly come before the meeting.

The Board of Directors unanimously recommends that you vote “FOR” each of the proposed director nominees and “FOR” the other proposals to be presented at the annual meeting.Annual Meeting.

Shareholders of record at the close of business on March 25, 202221, 2024 are entitled to vote at the meeting, either at the virtual annual meetingin person or by proxy. There are several ways to vote. You can vote your shares online, by telephone, by regular mail or in person at the virtual annual meeting.Annual Meeting.

To access your proxy materials and vote online, please visit www.proxyvote.comand follow the instructions. The notice provided to youYour proxy card or voting instruction form contains the necessary codes required to vote online. If you wish to vote by telephone, please call 1-800-690-6903 using a touch-tone phone and follow the prompted instructions. You may also vote by mail by requesting a papercompleting and returning your proxy card using the instructions provided to you in the notice.envelope provided. Finally, you may vote in person at the virtual annual meeting,Annual Meeting, even if you have previously submitted a proxy.

Whatever method you choose, please vote in advance of the meeting to ensure that your shares will be voted as you direct.

Boston, Massachusetts

April 8, 20225, 2024

By order of the Board of Directors

Wm. Gordon Prescott

EVP,Senior Executive Vice President, General Counsel and Corporate Secretary

Admission Procedures

The meeting is open to shareholders of Berkshire Hills Bancorp, Inc. To participate and voteEveryone attending the meeting should

bring a photo ID. If your shares atare registered in the Annual Meeting, you will need the 16-Digit Control Number included onname of a bank, broker, or other holder of record,

please also bring documentation of your Noticestock ownership as of Internet Availability of the proxy materials, on your proxy card or on the instructions that accompanied your proxy materials. March 21, 2024 (such as a brokerage

statement). Whether or not you plan to attend the meeting, we urge you to vote by proxy in advance to ensure your vote is counted if you decide not to attend the virtual meeting.

| | |

IMPORTANT NOTICE REGARDING AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON MAY 18, 2022:16, 2024: The Notice of Annual Meeting, 20222024 Proxy Statement, 20212023 Summary Annual Report, and 20212023 Annual Report on SEC Form 10-K are each available at www.proxyvote.com or ir.berkshirebank.com |

| | | | | | | | | | | | | | | | | |

| Table of Contents | | |

| |

|

|

| |

| Purpose.

Performance.

Progress. |

|

|

| | | | | | | | | | | |

| Proxy Summary | |

| | 20212023 Company PerformanceHighlights | |

| | 20212023 Executive Compensation Highlights | |

| | Shareholder Engagement and Responsiveness | |

| | Environmental, Social, Governance (ESG) & Corporate Responsibility and Sustainability | |

| Proposal 1 - Election of Directors | |

| | Information Regarding Directors and Director Nominees | |

| | Corporate Governance | |

| | Director Compensation | |

| Proposal 2 - Advisory (Non-Binding) Vote on Executive Compensation | |

| Compensation Discussion and Analysis (CD&A) | |

| | Compensation Committee Report | |

| Executive Compensation | |

| | Summary Compensation and Other Tables | |

| | Pay Versus Performance | |

| Proposal 3 - Ratification of the Appointment of the Independent Registered Public Accountant | |

| | Audit Committee Report | |

| Proposal 4 - Approval of the Berkshire Hills Bancorp, Inc. 2022 Equity Incentive PlanAdditional Information | |

| | Additional Information |

| | Stock Ownership | |

| | Information About Voting | |

| | Other Information Relating to Directors and Executive Officers | |

| | Submission of Business Proposals and Shareholder Nominations | |

| | Shareholder Communications | |

| | Miscellaneous | |

| | Other Matters | |

| Appendix A | A-1 |

| | Berkshire Hills Bancorp, Inc. 2022 Equity Incentive Plan | |

| Appendix B | |

| | Summary of and Reconciliation of Certain Non-GAAP Financial Measures | A-1 |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

1 BERKSHIRE HILLS BANCORP, INC. | 20222024 Proxy Statement

| | | | | | | | | | | | | | | | | |

| Berkshire Hills Bancorp, Inc. Proxy Statement | | |

| |

|

|

| |

| Purpose.

Performance.

Progress. |

|

|

Proxy Statement Summary

This summary gives you an overview of selected information in this year’s proxy statement. We encourage you to read the entire proxy statement carefully before voting. We have also provided you with the 20212023 Summary Annual Report and the 20212023 Annual Report on SEC Form 10-K.

Annual Meeting of Shareholders

Time and Date: 10:00 a.m. Eastern Time, Wednesday,Thursday, May 18, 202216, 2024

Place: Virtual meeting at www.virtualshareholdermeeting.com/BHLB2022Berkshire Bank, 99 North Street, Pittsfield, Massachusetts 01201

The only way to attend the meeting or vote at the meeting is through the internet.

Record Date: Shareholders as of the close of business on March 25, 202221, 2024 are entitled to vote

We are providing this proxy statement to you in connection with the solicitation of proxies for the 20222024 Annual Meeting of Shareholders and to transact any other business that may properly come before the meeting. In this proxy statement, we also refer to Berkshire Hills Bancorp, Inc. as “Berkshire” or the “Company”. We also refer to its subsidiary, Berkshire Bank, as the “Bank”“Bank". We are mailing a notice of the annual meetingAnnual Meeting and this proxy statement to shareholders of record as of March 25, 2022,21, 2024, beginning on or about April 8, 2022.5, 2024.

Summary of Proposals for 20222024

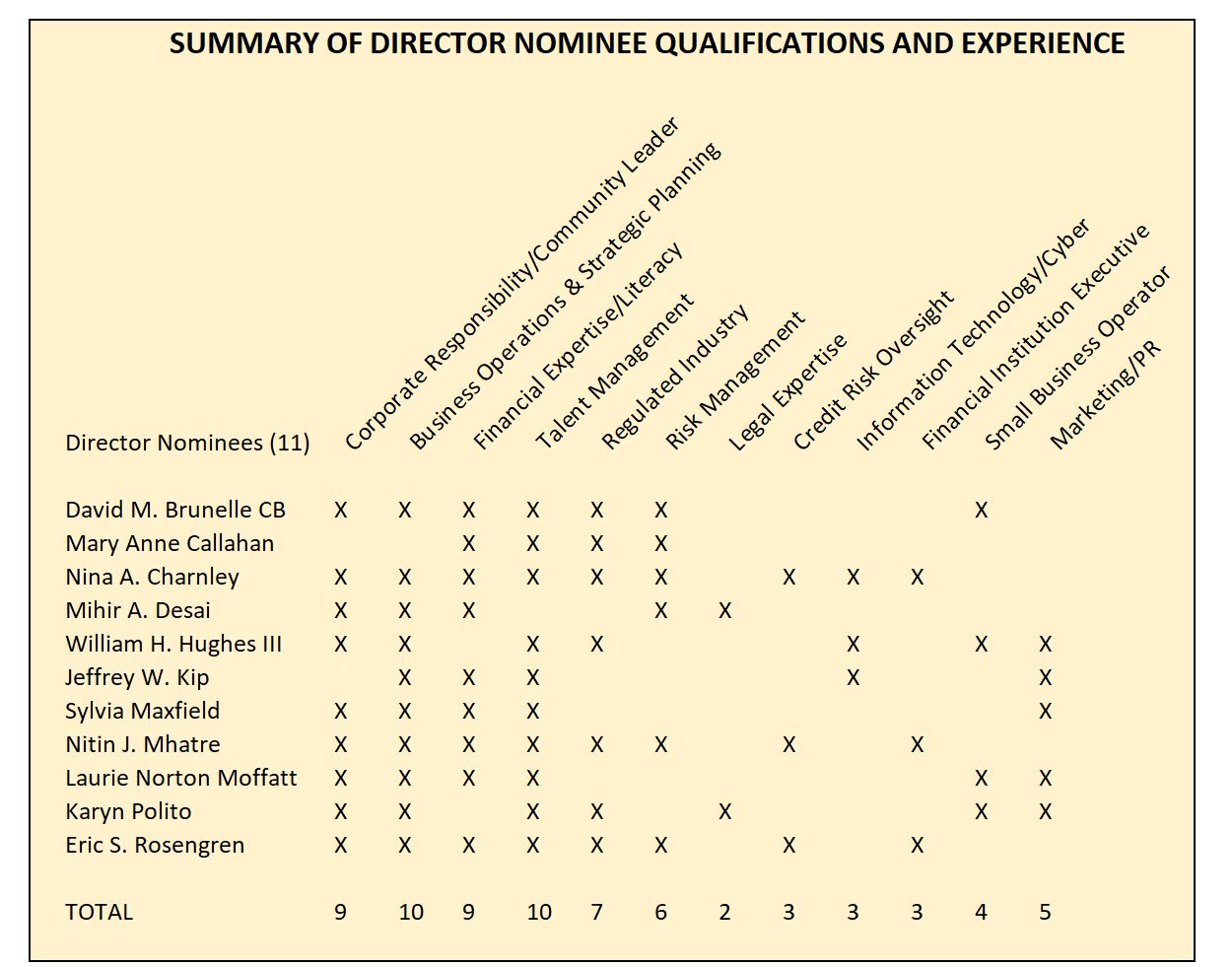

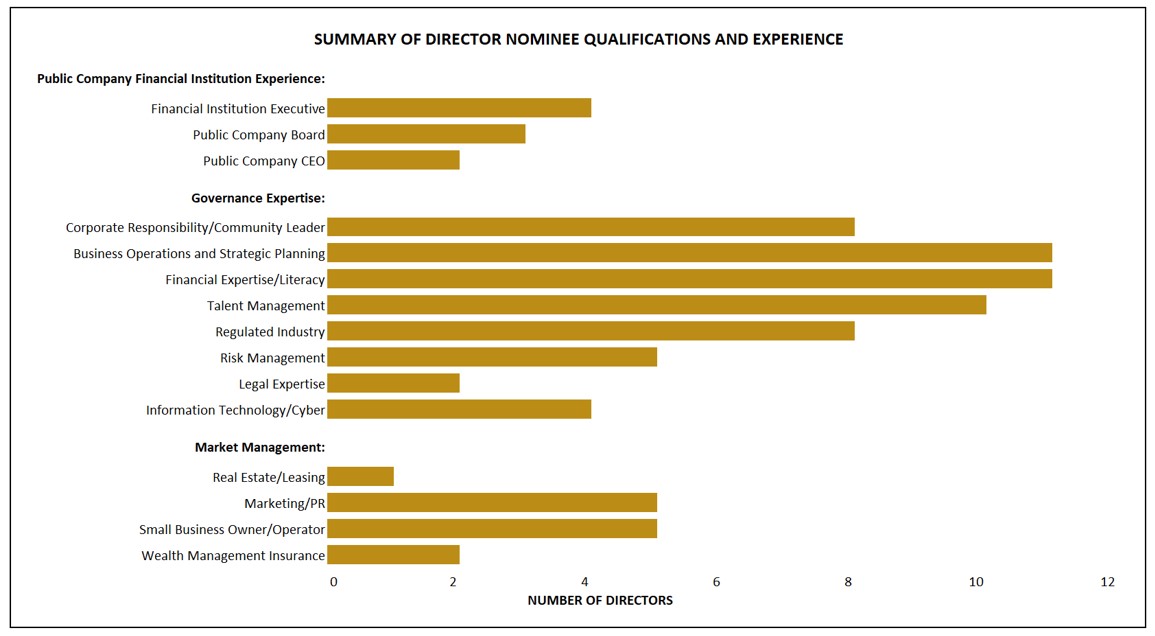

1 - Election of Directors. The Company’s Board of Directors is presenting twelve (12)eleven (11) nominees for election as directors at our Annual Meeting. OneTwo of the thirteen current director isdirectors, Messrs. Adofo-Wilson and Zaitzeff, are not standing for re-election. Director Callahan was appointed by the Board in September 2023. All nominees currently serve as directors on our Board of Directors.In 2021,2023, all director nominees received at least 96%98% of the votes cast regarding their nomination. Provided with this proposal is information about our directors, director nominees, corporate governance, and director compensation.

2 - Advisory Vote on Executive Compensation. This advisory vote is for the approval of the Company’s Named Executive Officer compensation as set forth within this proxy statement. Berkshire strives to promote shareholder value and sound risk management by aligning executive pay and company performance. The Compensation Discussion and Analysis (“CD&A”) explains the Board’s processes and decisions with respect to executive compensation. In 2021,2023, 97% of the votes cast were in favor of the proposal “FOR” the advisory approval of our Executive Compensation. Provided with this proposal is the Compensation Discussion and Analysis, the Compensation Committee Report, and Summary Compensation and Other Tables.

3 - Ratification of Independent Registered Public Accounting Firm. This advisory vote ratifies the selection of Crowe LLP (“Crowe”) as the Company’s independent registered public accounting firm for fiscal year 2022.2024. Crowe has served in this capacity since fiscal year 2017. In 2021,2023, 99% of the votes cast were in favor of the proposal for the appointment of Crowe.

4 - Berkshire Hills Bancorp, Inc. 2022 Equity Incentive Plan. This vote is for the approval of the proposed Berkshire Hills Bancorp, Inc. 2022 Equity Incentive Plan as set forth within the proxy statement. Provided with this proposal is a description of the proposed plan, and the plan is included as Appendix A.

2 BERKSHIRE HILLS BANCORP, INC. | 20222024 Proxy Statement

PROXY STATEMENT | PROXY STATEMENT SUMMARY

2021

2023 Company PerformanceHighlights

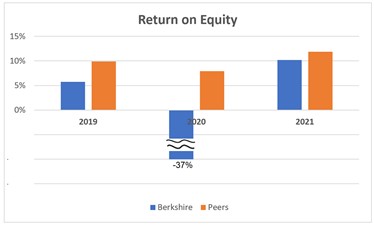

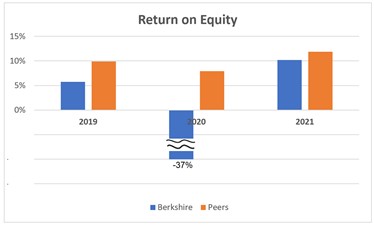

In 2021, Berkshire rebounded from the COVID-19 pandemic related loss in 2020 and posted higher earnings than in the prepandemichad a solid year of 2019. performance in 2023, building on core elements of its strategy to strengthen operations, deliver growth, and improve its long-term outlook. Earnings per share ("EPS") totaled $2.39$1.60 in 2021 increasing 21% over $1.97 reported2023 compared to $2.02 in 2019, and were recovered from2022. Results in 2023 included a $25 million ($0.58 per share) non-operating charge for the losssale of $10.60securities. The Company's non-GAAP measure of operating earnings totaled $2.14 per share in 2020. Return on equity nearly doubled to 10.18% in 2021,2023 compared to 5.75% reported$2.19 in 2019,2022. This measure is reconciled to GAAP measures in Exhibit A.

Bank industry operations in 2023 were affected by rising market interest rates and advanced more rapidly than peers. Earnings improvement reflected stronger credit performancethe related impacts on profitability, liquidity and capital, especially following a banking emergency in the first quarter that resulted in the second, third, and fourth largest bank failures in U.S. history. Berkshire maintained steady operations and proactively responded to changing industry conditions while also included gains achievedpursuing its longer term strategic objectives:

•Talent Recruitment. The Company opportunistically recruited executives and front-line commercial relationship talent with an emphasis on deposit, private banking, and wealth management professionals.

•Balance Sheet Growth. Total loans increased 8% and total deposits increased 3% year-over-year, producing a 7% increase in disposingnet interest income.

•Balance Sheet Strength. Capital, liquidity, and asset quality metrics all remained solid and supportive of lower return business lines.financial soundness, organic growth, and shareholder returns through dividends and buybacks.

•Expense Management. Ongoing procurement and optimization activities resulted in further branch consolidations, the sales of excess premises, and a workforce realignment.

PROFITABILITY – PREPANDEMIC TO 2021•Technology. The Company introduced its new mobile/digital banking platform, which positions the Bank well to respond to changing customer needs and competitive market offerings.

Note:Source – S&P Global Market Intelligence. ROE for 2020 was a loss due to Berkshire goodwill write-down.

Peers are LTI Industry Index median.

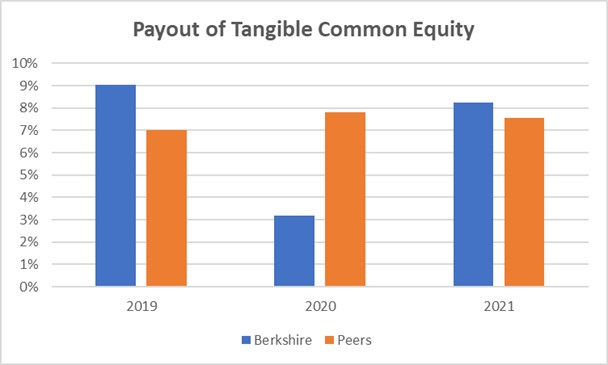

Berkshire also reintroduced share repurchases in 2021, after suspending this program in 2020 dueDue to the pandemic. Total shareholder distributions including stock buybackschallenges of the environment, one year and dividends in 2021 more than doubled year-over-year to 8.2% of tangible common equity, and also exceeded the peer average of 7.6% of tangible common equity.

Note:Source – S&P Global Market Intelligence. Peers are LTI Industry Index median.Ratio is sum of common dividends and common stock repurchases divided by average tangible common equity.

3 BERKSHIRE HILLS BANCORP, INC. | 2022 Proxy Statement

PROXY STATEMENT | PROXY STATEMENT SUMMARY

With improved earnings generation and increased shareholder distributions, Berkshire’s share price grew strongly and resulted in a 69%two year total shareholder return (TSR), nearly twice the return registered bywas negative for Berkshire, its proxy peers, and the KBW Regional BankBanking Index (KRX). While Northeastern banks underperformed this national index in both years, Berkshire was favorable to both its proxy peers and more thanthe national index for the two year TSR. Over three times higher than the returnyears, BHLB's 55% TSR exceeded both of the New York Stock Exchange Composite Index (NYA).

The 2021 stock price gain also included recognition of Berkshire’s Exciting Strategic Transformation (BEST) plan which was unveiled shortly before the 2021 Annual Shareholder Meeting This plan targets improved sustainable earnings and profitability,these industry groups as well as a stronger franchise based on leading rankings for customer satisfaction and environmental, social and governance (ESG) matters. The plan is targeted towards the Company’s vision to be a high-performing, leading socially responsible community bank in New England and beyond.S&P 500 index (SPX).

20212023 Executive Compensation Highlights

Included later in this report are compensation tables, including a Summary Compensation Table which details executive compensation provided in 2021,2023, as well as a Compensation Discussion and Analysis which provides information about the compensation management process and compensation decisions.

2021 was the first year under the leadership of Nitin Mhatre, who joined the Company as President and CEO in January 2021. During the year, the Company also filled key leadership roles, namely Subhadeep Basu as the CFO, Lucia Bellomia as the Head of Retail Banking and Ellen Steinfeld as the Head of Consumer Lending and Payments.

The Compensation Committee took amaintained the same overall balanced position towardsstructure for compensation decisionsmanagement in 2021, recognizing the challenges and uncertainties related to recent and expected performance due to the pandemic, while maintaining a compensation structure that supported management succession and incentivized improved performance. The Committee also recognized that the new CEO and the executive team should have near-term financial flexibility to invest in and initiate revised long-term strategies to achieve higher profitability.2023.

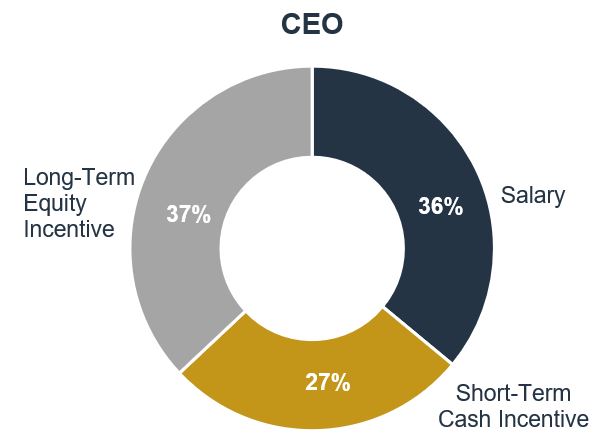

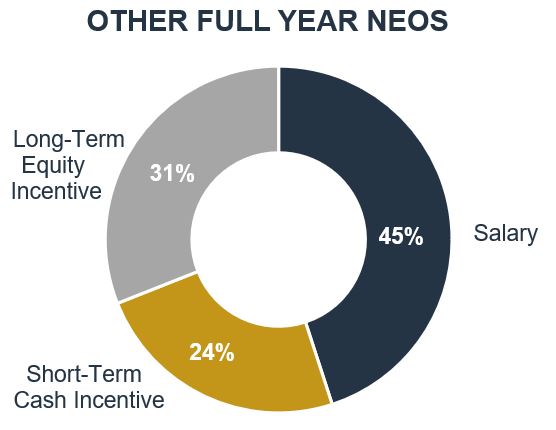

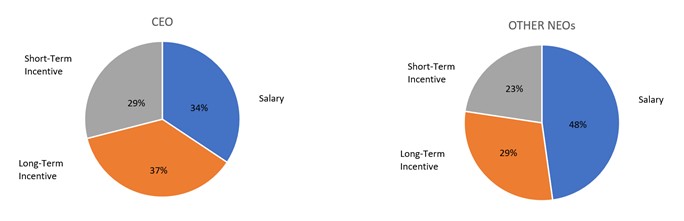

There were no material changes in our NEO target direct compensation in 2021 compared to 2020 and 2019. •Direct compensation includes salary, the cash-based short- termshort-term incentive, and the equity-based long-term incentive.

•Performance based compensation constitutes the majority of targeted direct compensation.

The cash-based short-term incentive

For those Named Executive Officers who served in their positions for the full year, total targeted direct compensation increased 7% year-over-year, reflecting higher salaries and incentives. Total direct compensation earned by the NEO’s in 2021 exceeded thethese positions was 1% below target due to the Company’s outperformance compared to goals setand decreased by the Board for executive management. Our performance reflected stronger credit performance as well as better operating efficiencies. In comparison, 2020 short-term incentives were paid below the original target due to8% year-over-year, including the impact of the pandemic on Company performance.performance below objectives in 2023.

The maturing three year long-term incentive performance compensation was forfeited in 2021 for the second year in a row due primarily to the 2020 pandemic impacts on relative performance. This reflects our continuing pay-for-performance philosophy.

4 BERKSHIRE HILLS BANCORP, INC. | 2022 Proxy Statement

PROXY STATEMENT | PROXY STATEMENT SUMMARY

The Committee’s decisions resulted in a compensation structure that rewarded outperformance where it was accomplishedthe achievement of Company objectives and decreased compensation from targets where objectives were not met. The positive stock performance in 2021, resulting in a 69% total shareholder return, and the long-term programs initiated under the BEST plan were viewed as critical accomplishmentsCompensation management was aligned with shareholder interests.interests and provides ongoing incentives to improve shareholder value.

3 BERKSHIRE HILLS BANCORP, INC. | 2024 Proxy Statement

PROXY STATEMENT | PROXY STATEMENT SUMMARY

Shareholder Engagement and Responsiveness

We have anIn addition to its active engagement program that reaches outoutreach and interactions with the investment community, the Company also solicits discussion and feedback annually to the governance and proxy voting teams of ouron corporate stewardship with its thirty largest institutional shareholders to solicit their feedback and answer their questions. This is in addition to our ongoing conversations with investors about the potential for our vision of purpose based performance to enhance value for all stakeholders.Further, we monitor position papers of proxy advisory firms and of our largest shareholders expressing current priorities and focus areas for corporate governance. We also spoke with advisors and other knowledgeable third parties, obtaining valuable additional feedback on our governance, compensation, and strategy.Based on these ongoing discussions, in recent years we have made several enhancements to our governance programs, including:shareholders.

| | | | | |

l | Declassified Board of Directors; all director positions are up for election in 2022 |

l | Increased Board diversity and added cyber-security and additional financial expertise |

l | In 2019, adopted new corporate guidelines implementing age and tenure limits to facilitate consistent Board refreshment |

l | Added new relative performance measures related to total shareholder return (“TSR”) and changes in return on equity to the long-term incentive plan |

l | Increased the three-year performance-based shares portion of long-term incentive compensation to 60% from 50% |

l | Made changes to target performance metrics in the short-term incentive plan to better align these measures with shareholder value maximization |

l | Increased the focus on long-term equity compensation |

l | Created a new Board-level Corporate Responsibility and Culture Committee, strengthening the Board’s oversight of human capital management and diversity, equity and inclusion initiatives |

During 2021,2023, the most frequent topics in our governance-relatedthese discussions have included our Berkshire’s Exciting Strategic Transformation (“BEST”) plan; our BEST Community Comeback financing plan; our focus on human capitalprocesses for managing board membership and shareholder meetings; governance of corporate sustainability programs; management including diversity, equity,of growth, efficiency, and inclusion; our pandemic response; climate change initiatives;employee turnover; and cyber security management.connecting strategy and compensation through the Company.

There is discussion ofrelated to these matters in following sections of the following section on Corporate Responsibility, as well as in our Summary Annual Report, our Annual Report on SEC Form 10-K, and our annual Corporate Social Responsibility Report. We believe that our top quartile ranking among U.S. Banks in our ESG ratings index evidences the recognition that we have earned through our response on many of these important issues. Additionally, basedproxy statement. Based on the affirmative shareholder vote of 96%97% or higher for all items on last year’s annual meetingAnnual Meeting agenda and based on the strong outperformanceinvestor feedback and recognition of our stock in 2021,Berkshire's vision, positioning, and initiatives, we believe that our investors are strongly supportive of our programs for governance and company performance.

5 BERKSHIRE HILLS BANCORP, INC. | 2022 Proxy Statement

PROXY STATEMENT | PROXY STATEMENT SUMMARY

Our Commitment to Environmental, Social, Governance (ESG) & Corporate Responsibility and Sustainability

Berkshire's Approach

Since its founding in 1846, Berkshire is committedremains a purpose-driven and values-guided institution working to purpose-driven, community-centered banking that enhances value for all stakeholders as it pursuesachieve its vision of beingbecoming a high performing, leading socially responsible community bankhigh-performing, relationship-driven, community-focused bank. Berkshire empowers the financial potential of its stakeholders by delivering industry-leading financial expertise and a full suite of tailored banking solutions through its consumer banking, commercial banking and wealth management divisions to clients in New England and beyond. We’reNew York. For more than 175 years, Berkshire has provided strength, stability and trusted advice to create a bank with a purpose:positive impact for its clients and communities while upholding equitable, ethical, responsible and sustainable business practices.

Berkshire’s longstanding commitment to empoweroperating equitably, responsibly and sustainably is interwoven into the financial potential of individuals, familiescompany’s vision, mission, business practices, and businesses in our communities. We providestrategic goals. Berkshire’s integrated approach to managing environmental, social and governance externalities helps reduce risk and unlock new business opportunities to create an ecosystem of socially responsible financial solutions, actively engagepositive impact and value, which in turn drives Berkshire’s commercial performance, creating capacity to invest more in its business, employees, customers, shareholders and communities.

2023 Highlights

•Record high employee engagement contributing to declining turnover

•Allocated an amount equal to the proceeds of Berkshire’s $100MM sustainability bond to create affordable/workforce housing and green building development

•100% on-premises renewable electricity and reduced Greenhouse Gas emissions

•Recognized with our communities,the Communitas Award for Leadership in Corporate Social Responsibility, named one of America’s Most Trustworthy Companies and harness the powerAmerica’s Best Regional Banks by Newsweek and America’s Best Midsize Employers by Forbes.

•Top 20% aggregated ESG rating*, achieving one of our entirefive major strategic goals

*National ranking among U.S. banks as of December 31, 2023

Oversight & Responsibility

The management of material environmental, social and governance factors is integral to Berkshire’s business to fuel the economy, promote thriving neighborhoods, foster financial access and success, and invest in a low-carbon future.

At Berkshire, our most important investment for 175 years has been the one we make in each other. We know that where you bank matters and building stronger communities requires a better approach to banking. As such, ESG factors are central to our vision, mission,practices, risk management practices,program, competitive positioning and Berkshire’s Exciting Strategic Transformation (BEST).

BEST Community Comeback

In 2021, welaunched the BEST Community Comeback, a transformational $5 billion commitmentits ability to empower our stakeholders’ financial potential. The plan focusesdeliver on four key areas: supporting small business growth; community financingits strategic priorities and philanthropy; financial access and empowerment; and funding environmental sustainability. Through this far-reaching initiative,vision. Berkshire aims to help create more businesses and jobs, help more families achieve the dream of owning a home, and aid communities in becoming more environmentally efficient and eco-friendly.

Ongoing Pandemic Support

As 2021 continued to present new challenges, we remained committed to serving our customers and communities. We’re guided by our Be FIRST Values of Belonging, Focusing, Inclusion, Respect, Service, and Teamwork. These values fueled our efforts to navigate the pandemic with the goal of supporting the health and economic resiliency of all our stakeholders. During the height of the pandemic, Berkshire created the You FIRST employee assistance fund to help staff impacted by unexpected financial hardships, provided additional paid sick time, flexible work schedules for remote staff, and maintained full pay for those with reduced schedules as a result of the pandemic. Small businesses and consumers were helped with loan forbearances and government assistance programs. We also launched a fund to assist businesses in the LGBTQIA+ and Black, Indigenous and People of Color (BIPOC) communities.

ESG Program & Business Integration

We’re committed to integrating social, environmental and reputational considerations into all business decision making through our strong foundation of governance systems, including:

•Corporate Responsibility & Culture Committee of our Board of Directors,

•Environmental, Social and Governance (ESG) Management Committee,

•Diversity Equity & Inclusion Management Committee,

•Responsible & Sustainable Business Policy,

•Strong collection of Social & Environmental risk management practices, and

•Senior managers of Corporate Responsibility and of Diversity

Berkshire engages directly with its stakeholders to share information about the progress we’ve made in our ESG and DEI performance, including through our Corporate Responsibility website, corporate annual report, and proxy statement. Additionally, our annual Corporate Responsibility Report, which is aligned with Sustainability Accounting Standards Board (“SASB”) commercial bank disclosure topics, details the Company's ESG efforts and programs.

6 BERKSHIRE HILLS BANCORP, INC. | 2022 Proxy Statement

PROXY STATEMENT | PROXY STATEMENT SUMMARY

ESG Oversight

The Board of Directors ultimately oversees the strategy and activities of the Company including ESG. In order to drive forward our vision to be a leading socially responsible community bank, we werewas one of the first banks in the country to establish a dedicated committee of ourits Board of Directors to oversee ESG matters.corporate culture, diversity and sustainability. The Company is a leader among community banks in integrating these practices into its business strategy and operations.

The Corporate Responsibility andCompany’s strong foundation of governance systems include:

•Board level oversight of Culture, Committee is responsible for overseeing the management of the Company’s enterprise-wide Corporate Responsibility/ESG, Environmental Sustainability, Community, Climate Change, and Diversity Equity

•Environmental, Social and Governance (ESG) Committee

•Responsible & Inclusion,Sustainable Business Policy and Culture programs. It complements other Committees of the Board who oversee material topics within their scope of responsibilities to provide full oversight to ESG matters.Climate Risk Management Program

•Lending, credit, deposit and investment policies which incorporate environmental and social considerations along with due diligence requirements

In addition to the Board•Active involvement from business unit leaders and its Committees, an ecosystem of management-level committees support various components of our ESG strategy. Our ESG Committee, which is comprised of members of the executive management team, monitorsfront lines in managing externalities and approves strategies designed to identify, measure, control,risks

•Senior leadership for corporate responsibility and enhance the Company’s ESG/Corporate Responsibility performance.

sustainability

74 BERKSHIRE HILLS BANCORP, INC. | 20222024 Proxy Statement

PROXY STATEMENT | PROXY STATEMENT SUMMARY

The Board of Directors including its Corporate Responsibility & Culture Committee (CRCC) has ultimate oversight responsibility for environmental, social and governance matters. The CRCC meets quarterly to review performance, examine related risks, and approve relevant policies. Berkshire’s comprehensive approach ensures that the board receives regular reports from management on environmental and social dimensions of its business such as human capital management, diversity, stakeholder relations, climate change, community impact, and cybersecurity. It allows the board to develop a sufficient understanding of the Company’s impacts, management’s programs to mitigate those risks and capture opportunities. It helps inform strategic planning, create accountability and, along with management committees and senior leaders, provides visibility throughout the organization.

Berkshire regularly engages directly with its stakeholders to share information about the progress it’s made in its performance, including through its website, corporate annual report, and proxy statement. Additionally, Berkshire’s Sustainability Report, which is informed by Sustainability Accounting Standards Board (“SASB”) and Task Force on Climate-Related Financial Disclosure (TCFD) disclosure standards, details the Company's programs and performance. The report is available at berkshirebank.com/esg

Climate Change

Climate change poses unprecedentedmanifesting in the form of both physical or transition risks and opportunities to the world, including Berkshire, its customers and communities. The impacts which can occur from climate change cancould adversely affect either directly and/or indirectly, impact the CompanyBerkshire’s operations, businesses, customers, communities, and its stakeholders. As the transition to a low-carbon economy accelerates, new policy emerges,policies emerge, and market dynamics shift, Berkshire expects that its efforts to manage its environmental footprint, mitigate the risks associated with climate change, and support the transition will allow it to strengthen its positioning as a high performing, leading socially responsible community bank.competitive positioning. The Company continues to evolve its practices to reflectalign with its community bank mission, current and expected regulations as well as the size, scope, and complexity of its operations.

Berkshire enhancedClimate change and its governance over material environmental matters in 2021 by formalizing an Environmental, Socialassociated physical and Governance management committeetransition risks are managed through Berkshire’s formal Climate Risk Management Program which outlines roles and completing a formal climate change risk assessment to evaluateresponsibilities for the bank’s operations and lending activities for potential exposure to transition and physical risks resulting from climate change.

•The results of the risk assessment guide Berkshire’s forward climateboard, management and all employees, definitions, along with procedures for identifying, measuring and assessing climate risk. The program also lays out Berkshire’s system of controls which include governance mechanisms, formal policies, due diligence and insurance requirements, exclusionary criteria, business continuity planning, external relations, and employee education. Finally, the program sets expectations for responses to risk events or elevated risk levels, reporting and external disclosure. Further information on Berkshire’s environmental sustainability strategies.

•We have setactivities and its approach to governance, risk management, strategy, metrics & targets to help finance the green transition, reduce its Greenhouse Gas (GHG) emissions and source 100% of our electricity from renewable sources by the end of 2024.

•As the Company moves further alongnext steps can be found in its climate journey, it expects to continue to enhance its plans, disclosures, programs and initiatives to reduce its emissions as well as capitalize on the many business opportunities arising from the transition to a lower-carbon economy.most recent Sustainability Report.

Ratings, Awards & Recognition

We’re proud to be recognized for our performance with local, regional, national, and international awards as well as leading third party ESG ratings* including:

•MSCI ESG- BBB

•ISS ESG Quality Score - Environment: 3, Social: 1, Governance: 2

•Bloomberg ESG Disclosure- 47.81

•The Company is also rated by Sustainalytics

•Banking Northeast Community Champion Award

•Communitas Award for Leadership in Corporate Social Responsibility

•Bloomberg Gender-Equality Index

•Human Rights Campaign Corporate Equality Index Best Place to Work for LGBTQ+ equality- 100% Score

*As of December 31, 2021

8 BERKSHIRE HILLS BANCORP, INC. | 2022 Proxy Statement

PROXY STATEMENT | PROXY STATEMENT SUMMARY

HUMAN CAPITAL MANAGEMENT

Berkshire’s people are the core of its ability to deliver on its Berkshire’s Exciting Strategic Transformation (BEST) plan and vision of being a high performing, leading socially responsible community bank in New England and beyond. The Company’s approach to human capital management is grounded in its Be FIRST values and focuses on:

•Strong oversight and risk management practices

•Recruitment

•Compensation & Benefits

•Retention, Training, Development & Engagement

•Health & Wellness

Oversight

The Board of Directors has ultimate responsibility for the strategy of the Company. The Compensation Committee of the Board of Directors oversees executive compensation matters and the Corporate Responsibility & Culture committee oversees company culture, diversity, and employee engagement. The Company proactively identifies potential human capital related risks, such as the labor market shortage, rising labor costs, and employee retention and designs strategies to mitigate those risks. Strong human capital management is viewed as integral to the Company's strategic transformation.

Recruitment

Berkshire operates in a highly competitive labor market with strong competition for top talent. To help power Berkshire’s transformation, it relies on and continues to recruit employees with the right mix of skills, expertise and experiences. The Company leverages several strategies to support its talent pipeline and talent acquisition activities including internship placements, affinity group relationships, and the use of experienced recruiters for key management and specialized positions.

Berkshire continues to pursue a hybrid work model to expand its access to top talent and provide its employees with workplace flexibility. These strategies have proved effective in meeting the demand for talent demonstrated by the Company’s strong track record attracting new talent across retail, commercial, wealth management, business banking and operational areas. In addition, as market disruptions from mergers remain, Berkshire will continue to leverage its differentiated brand and unique market positioning to hire community-focused bankers from its competitors.

Compensation & Benefits

While the labor market shortage and other factors can contribute to increased labor costs, Berkshire continually evaluates its strategies and looks at best practices to provide competitive pay and benefits packages that reward performance and retain top talent at all levels of the Company. The Company offers comprehensive medical coverage, paid vacation and personal time, along with other benefits, all of which are available to married same-sex or different-sex couples as well as domestic partners. In addition to its compensation and health benefits, Berkshire offers volunteer-time off, an employee assistance program, regular performance reviews and the You FIRST Fund to help employees impacted by personal financial hardships.

Retention, Training, Development & Engagement

Strong employee retention will help reduce expense, create efficiencies and contribute to the success of BEST. In addition to compensation and benefits packages, Berkshire employs a collection of strategies to strengthen employee retention. The Company offers a menu of development and training programs consistent with one’s job responsibilities and professional goals including a mentoring program to pair high potential junior employees with senior staff. Berkshire continues to reskill and upskill employees from across the Company to take on new responsibilities and roles. For employees looking to expand their professional experience in the classroom, the Company offers an education assistance program. In 2021, Berkshire further enhanced its commitment to creating a strong workplace culture by rolling out a comprehensive employee engagement survey to identify strengthens and opportunity areas within the organization. Action plans were developed in areas that did not meet the Company’s high expectations. It expects to continue to enhance its efforts through intentional actions including offering a new employee rewards and recognition program.

9 BERKSHIRE HILLS BANCORP, INC. | 2022 Proxy Statement

PROXY STATEMENT | PROXY STATEMENT SUMMARY

Health & Wellness

Like all businesses, Berkshire has been impacted by the ongoing COVID-19 pandemic and continues to proactively manage impacts to protect the health and safety of its employees, customers and communities as well as retain and attract top talent. During the height of the pandemic, the Company provided protective equipment to front-line employees, including masks and gloves, and offered all additional paid sick time, paid vaccine time, paid quarantine/isolation leave, job protected personal leave, flexible work schedules for remote employees, premium pay for onsite employees and maintained full pay for employees with reduced schedules, as a result of the pandemic. The Company continues to maintain a largely hybrid working environment with the majority of non-branch staff working remotely at least part-time.

Future of the Workplace

Berkshire continues to evolve and enhance its human capital management strategies to help drive organizational growth in support of BEST while combating risks, such as the labor market shortage and rising labor costs. The Company intends to continue to evolve its workplace model into a hybrid environment over the long-term. It also plans to pursue its DigiTouch™ service delivery model, a powerful combination of personal service driven by bankers fused with the convenience of user-centric technology that combined, delivers a superior customer experience. While technology will play a bigger role in the future of Berkshire helping to improve processes and drive efficiencies, people will always be at the core of its ability to deliver value to its customers and communities. The Company remains confident that the Berkshire brand, value proposition and socially-responsible vision will continue to be a differentiator in the market and help overcome labor market disruptions.

Diversity, Equity & Inclusion

Creating a diverse, equitable,accessible, inclusive and inclusiveequitable workplace is an essential enabler to advancing the Company’s strategic goals, social and environmental commitments and vision. Ultimately Berkshire’s goal is to attract and retain individuals from a critical component towide range of backgrounds, cultures and experiences so that the successworkforce, executives and board composition reflect the diversity of Berkshire’s Exciting Strategic Transformation (BEST) and its BEST Community Comeback. At the core of Berkshire’s strategy is a goal to ensure that its workforce reflects the communities in which it operates, that itsoperates. It also seeks to ensure equity, accessibility, fairness and impartiality in all aspects of the Company’s workplace, banking practices and financial solutions while fostering an inclusive environment where all employees feel that they are valued, respected and can reach their full potential and that it leverages its core business to improve the access and affordability of financial solutions to support economic growth of under-represented populations and communities.empowered.

The Company instituted a strong foundation ofadvances those goals through an integrated approach that includes:

•Strong oversight and governance practices to ensure that diversity, equity and inclusion is embedded into Berkshire’s business activities. This includesthrough the Corporate Responsibility & Culture Committee of the Board of Directors which has ultimate oversight responsibility.and management committees

•Talent management and recruitment

•Education and training and workplace programming

•Seven employee resource groups

•Workplace programming

•Multicultural community engagement

•Equitable product and service development and supplier diversity

Additional detailed information on Berkshire’s Human Capital Management and Diversity, Equity & Inclusion Committee, which reports into the Board committee, provides additional management level oversight topractices can be found in the Company’s programmingannual SEC report on Form 10-K and performance. To further strengthen those efforts in 2021, Berkshire named a Senior Vice President/Chief Diversity Officer.

The Company continues to work to improve representation within its workplace leveraging a combination of strategies. Berkshire identifies opportunities in targeted marketsannual Sustainability Report, which details the company's environmental, social and business lines, develops deeper partnerships with non-profit organizations and affinity groups and uses external recruitment professionals to ensure it receives candidate pools that reflect the rural and urban communities in which it operates. In addition, the Company regularly reviews the gender and ethnic diversity of its workforce at the employee, manager and executive management level.

| | | | | | | | | | | |

Diversity & Inclusion* | ◦ | Percent of women in workforce | 67 | % |

◦ | Percent of ethnic minorities in workforce | 15 | % |

◦ | Percent of women on the Board | 25 | % |

◦ | Percent of ethnic minorities on the Board | 33 | % |

◦ | Percent of women in management (officer+) | 20 | % |

◦ | Percent of ethnic minorities in management (officer+) | 4 | % |

*Employee metrics reported are as of December 31, 2021. Board metrics based on 2022 Board nominees.

governance programs.

105 BERKSHIRE HILLS BANCORP, INC. | 20222024 Proxy Statement

PROXY STATEMENT | PROXY STATEMENT SUMMARY

Berkshire provides a full suite of diversity, equity & inclusion trainings to build understanding and afford employees with strategies they can put into practice. All employees complete training annually. In addition, Berkshire offers seven Employee Resource Groups (ERGs) each playing an integral role for employees and the culture of the company. Every Employee Resource Group provides a safe space for dialogue, education, and collective action on topics relevant to their members and the Company. Through the ERGs, employees concerns and ideas to strengthen Berkshire’s culture are elevated to members of management and the Diversity, Equity & Inclusion Committee for action, empowering employees to collectively be engines of positive change within the workplace.

Find out more about Berkshire’s Commitment to Environmental, Social and Governance matters and our BEST Community Comeback in our 2021 Corporate Responsibility Report.

11 BERKSHIRE HILLS BANCORP, INC. | 2022 Proxy Statement

| | | | | | | | | | | | | | | | | |

| | | | | |

| Proposal 1: Election of Directors for a One-Year Term | | |

| |

| | Purpose.

Performance.

Progress.

|

|

The Company’s Board of Directors has nominated and recommends a vote “FOR” each of the twelve (12)eleven (11) nominees listed below for election as a director. All of the nominees currently serve on the Company’s Board of Directors.

Background. The Company’s Board of Directors is presenting twelve (12)eleven (11) nominees for election as directors at our Annual Meeting. EachTwo of the thirteen current directors, Messrs. Adofo-Wilson and Zaitzeff, are not standing for re-election. All of the nominees currently serve as a directordirectors on the Company's Board of Directors. Each director elected at the meeting will serve for a one-year term until our 2023 annual meeting2025 Annual Meeting or until a successor is duly elected and qualified. Each director nominee has consented to being named in this proxy statement and to serving as a director if elected. If a nominee is unable to be a candidate when the election takes place, the shares represented by valid proxiesproxies will be voted in favor of the remaining nominees. The Board of Directors does not currently anticipate that any of the nominees will be unable to be a candidate for election. Director Rheo A. Brouillard (age 68, 3 years of service) is not standing for re-election. Directors Nina A. Charnley, Mihir A. Desai, and Jeffrey W. Kip are new directors elected by the Board during the year and are standing for their first shareholder election.

Agreement with HoldCo Asset Management. On March 7, 2021, the Company entered into a cooperation agreement (the “Cooperation Agreement”) with HoldCo Asset Management, LP (“HoldCo”), an investment adviser which owns approximately 3.5% of the Company’s outstanding shares. Pursuant to the Cooperation Agreement, the Company agreed that it would nominate Michael Zaitzeff, Co-Founder and Managing Member of VM GP II LLC, the general partner of HoldCo, as a new independent director. Mr. Zaitzeff has agreed to stand for re-election in 2022. Pursuant to the Cooperation Agreement, Mr. Zaitzeff may select a replacement for his position, subject to the terms stated in the agreement.

The foregoing description is qualified in its entirety by reference to the Cooperation Agreement, a copy of which is attached as Exhibit 10.1 to the Company’s Current Report on Form 8-K filed with the SEC on March 8, 2021.

Election. The affirmative vote of a plurality of the Company’s outstanding common stock present at the virtual annual meetingAnnual Meeting or by proxy at the Annual Meeting is required to elect the nominees for directors; provided, however, in the case of an uncontested election of directors, it is the Company’s policy that if a director is elected by a plurality but not a majority of the votes cast for such director, such director must submit his or her resignation to the Board of Directors, which will be subject to review by the Corporate Governance/Nominating Committee of the Board of Directors. The Corporate Governance/Nominating Committee will then make a recommendation to the Board of Directors as to whether to accept or reject the director’s resignation. Unless otherwise instructed, the proxy holders will vote the proxies received by them “FOR” the election of the nominees as directors.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS VOTE “FOR” THE ELECTION OF ITS DIRECTOR NOMINEES.

126 BERKSHIRE HILLS BANCORP, INC. | 20222024 Proxy Statement

PROPOSAL 1: ELECTION OF DIRECTORS |INFORMATION REGARDING DIRECTORS AND DIRECTOR NOMINEES

Information Regarding Directors and Director Nominees

20222024 Nominees for Election to the Board of Directors

| | | | | | | | | | | | | | | | | |

BAYE ADOFO-WILSON, CEO OF BAW DEVELOPMENT, LLC |

| Mr. Adofo-Wilson, Esq. is CEO of BAW Development, LLC, a national real estate development company concentrating on redevelopment and consulting services in diverse communities. He is also Of Counsel at Post Polak, PA focusing on redevelopment law and specializing in New Jersey’s urban transitioning communities and municipalities, He has over 20 years of experience in law and business development, with a focus on community development, including the position of Deputy Mayor/Director, Economic and Housing Development for the City of Newark, New Jersey.

|

|

|

|

|

|

|

|

Independent | Qualifications, Skills, and Experience: |

Years of Service: 3 | | Business Operations/Strategic | | Regulated Industry |

Age: 53 | | Planning | | Corporate Responsibility/ |

Board Committees: | | Financial Expertise/Literacy | | Community Leader |

| Audit | | Talent Management | | Small Business Owner/Operator |

| Compliance & Regulatory | | Real Estate | | Legal Expertise |

| Corporate Responsibility | | | | |

| and Culture | | | | |

| | | | | | | | | | | | | | | | | |

DAVID M. BRUNELLE, CHAIRPERSON OF THE BOARD OF DIRECTORS OF BERKSHIRE HILLS BANCORP, INC.,CO-FOUNDER AND MANAGING DIRECTOR OF NORTH POINTE WEALTH MANAGEMENT |

| Mr. Brunelleis Co-Founder and Managing Director of North Pointe Wealth Management in Worcester, Massachusetts. He has over 20 years of experience in financial services working with businesses, individuals, families and charitable foundations. Mr. Brunelle is a former Director of Commerce Bancshares Corp. and Commerce Bank & Trust Company and served on Commerce’s audit and loan committees. He has also served as trustee or corporator for numerous non-profit entities in and around Worcester, including The Nativity School of Worcester, The Worcester Regional Research Bureau, The Worcester Educational Development Foundation, the UMass/Memorial Foundation, Becker College and the Greater Worcester Community Foundation. |

|

|

|

|

|

|

|

| Independent | Qualifications, Skills, and Experience:Board Committees: |

Years of Service: 46 | | Public Company Board | | Talent ManagementCompensation |

Age: 5153 | | Business Operations/Strategic | | Regulated Industry |

Board Committees: | | Planning | | Corporate Responsibility/ |

| Corporate | | Financial Expertise/Literacy | | Community Leader |

| Governance/Nominating (Chair) | | Risk Management | | Small Business Owner/Operator |

| | Compensation | Wealth Management/Insurance | | |

| Corporate Responsibility & | | | | |

| Regulatory | | | | Culture |

| | | | | | | | | | | | | | | | | |

| MARY ANNE CALLAHAN |

| Ms. Callahan has more than 35 years of investment banking expertise, most recently as a Managing Director in the Financial Services Group at Piper Sandler Companies where her responsibilities included advising bank management and boards of directors in the Northeast region on a broad range of strategic and financial topics. Previously she was a principal in Sandler O’Neill & Partners, L.P.’s investment banking group advising banks, thrifts and specialty finance companies and worked in the financial institutions group at Merrill Lynch and CIBC World Markets. |

|

|

|

|

|

|

|

| Independent | Board Committees: |

| Years of Service: <1 | | Compensation |

| Age: 61 | | Risk Management, Capital & Compliance |

137 BERKSHIRE HILLS BANCORP, INC. | 20222024 Proxy Statement

PROPOSAL 1: ELECTION OF DIRECTORS |INFORMATION REGARDING DIRECTORS AND DIRECTOR NOMINEES

| | | | | | | | | | | | | | | | | |

| NINA A. CHARNLEY, FORMER SENIOR MANAGING DIRECTOR, TIAA |

| Ms. Charnley was Senior Managing Director, Enterprise Customer Experience Executive at TIAA. Ms. Charnley led the strategy, development and execution of a significant portfolio of technology projects launching the company's mobile app and a digital bank, building digital capabilities enabling employees and customers. Previously, she was an executive at Bank of America managing diverse businesses including a de novo sustainable energy lending program and created the strategy, infrastructure, template and accountabilities matrix for Bank of America's Diversity and Inclusion program. Ms. Charnley has been designated by the Board of Directors as a financial expert under the rules of the Securities and Exchange Commission

|

|

|

|

|

|

|

|

| Independent | Qualifications, Skills, and Experience:Board Committees: |

Years of Service: <12 | | Financial Institution Executive | | Talent ManagementAudit |

Age: 6668 | | Business Operations and Strategic | | Regulated IndustryCorporate Responsibility & Culture |

| Board Committees: | Planning | | Corporate Responsibility/ |

| Compensation | | Financial Expertise/Literacy | | Community Leader |

| Compliance & Regulatory | | Risk Management, | | Information Technology/Cyber |

| Corporate Responsibility | | | | |

| Capital, & Culture | | | | Compliance |

| | | | | | | | | | | | | | | | | |

JOHN B. DAVIES, AGENT EMERITUS WITH MASSACHUSETTS MUTUAL LIFE INSURANCE |

| Mr. Davies is a former Executive Vice President of Massachusetts Mutual Life Insurance and is currently an Agent Emeritus with Massachusetts Mutual, providing high net worth counseling with a focus on tax efficiency and intergenerational transfers of wealth. Mr. Davies currently serves on the Westfield State University Foundation Board. Mr. Davies is a former director of Woronoco Bancorp, Inc.

|

|

|

|

|

|

|

|

Independent | Qualifications, Skills, and Experience: |

Years of Service: 16 | | Public Company Board | | Regulated Industry |

Age: 72 | | Financial Institution Executive | | Wealth Management/Insurance |

Board Committees: | | Business Operations/Strategic | | Talent Management |

| Compensation (Chair) | | Planning | | Corporate Responsibility/ |

| Corporate | | Financial Expertise/Literacy | | Community Leader |

| Governance/Nominating | | | | |

14 BERKSHIRE HILLS BANCORP, INC. | 2022 Proxy Statement

PROPOSAL 1: ELECTION OF DIRECTORS |INFORMATION REGARDING DIRECTORS AND DIRECTOR NOMINEES

| | | | | | | | | | | | | | | | | |

| MIHIR A. DESAI, PROFESSOR OF FINANCE, HARVARD BUSINESS SCHOOL & PROFESSOR OF LAW, HARVARD LAW SCHOOL |

| Dr. Desai is the Mizuho Financial Group Professor of Finance at Harvard Business School, and Professor of Law at Harvard Law School. Dr. Desai is an accomplished author and expert in finance and tax policy. He is a Research Associate in the National Bureau of Economic Research’s Public Economics and Corporate Finance Programs. In addition to his work at Harvard University, his professional experiences include CS First Boston, McKinsey & Co., and advising a number of firms and governmental organizations. |

|

|

|

|

|

|

|

| Independent | Qualifications, Skills, and Experience:Board Committees: |

Years of Service: <12 | | Financial Expertise/Literacy | | Legal ExpertiseCompensation |

Age: 5456 | | Business Operations and Strategic | | Corporate Responsibility/ |

Board Committees: | | Planning | | Community Leader |

| Risk Management, Capital & Capital | | Risk Management | | |

| Compliance & Regulatory | | | | |

| | | | | | | | | | | | | | | | | |

| WILLIAM H. HUGHES III, PRESIDENT AND CEO OF EDUCATION DESIGN LAB |

| Mr. Hughes is President and CEO of Education Design Lab, an innovation engine that applies human-centered designa national nonprofit focused on expanding opportunity at the intersection of learning and work in order to provide alternative career pathways and close the skills gap. As a technology industry executive, Mr. Hughes has launched, led and advised multiple new ventures, providing expertise on strategy, innovation and product management.work. He has been a leader, entrepreneur, innovator and board member in educational technology for the past two decades of experience advising senior executives at industry-leading multinationals on corporate strategy, partnerships and technology across several sectors, including education and financial services. He has led and advised multiple mergers, acquisitions and start-ups. Mr. Hughes has served on several corporate and not-for-profit boards. He is a trustee of Education Development Center, a director ofcompanies such as Pearson, Cengage, Kaplan, EDC, FineTune Learning (acquired by Prometric) and aIntellus Learning (acquired by Macmillan). In his earlier career, he held leadership positions in technology and venture partner with 11 Tribes Ventures.development at Sapient and Cambridge Innovation Center. His more than 30 years of business experience spans strategy, product, services, business development, partnerships, AI and cybersecurity.

|

|

|

|

|

|

|

|

| Independent | Qualifications, Skills, and Experience:Board Committees: |

Years of Service: 35 | | Business Operations/Strategic | | Talent ManagementCorporate Governance/Nominating |

Age: 5860 | | Planning | | Regulated Industry |

Board Committees: | | Information Technology | | Corporate Responsibility/ |

| Compensation | | Product Management | | Community Leader |

| Risk Management and | | Cybersecurity | | Small Business Owner Operator |

| Capital (Chair) | | | | |

| Corporate Responsibility & | | | | |

| Culture | | | | |

158 BERKSHIRE HILLS BANCORP, INC. | 20222024 Proxy Statement

PROPOSAL 1: ELECTION OF DIRECTORS |INFORMATION REGARDING DIRECTORS AND DIRECTOR NOMINEES

| | | | | | | | | | | | | | | | | |

| JEFFREY W. KIP, CHIEF EXECUTIVE OFFICER OF ANGI INTERNATIONAL |

| Mr. Kip is Chief Executive Officer of Angi International which provides internet tools and resources for home improvement, maintenance, and repair projects. Angi International is a subsidiary of IAC/InterActive Corp (NASDAQ: IAC), which owns and manages popular online brands and services. Prior to his role as Chief Executive Officer, Mr. Kip was the Chief Financial Officer of IAC/InterActive Corp from 2012-2016. Mr. Kip's previous positions include Chief Financial Officer of Panera Bread, LLC from 2006 – 2012. Mr. Kip has been designated by the Board of Directors as a financial expert under the rules of the Securities and Exchange Commission |

|

|

|

|

|

|

|

| Independent | Qualifications, Skills, and Experience:Board Committees: |

Years of Service: < 12 | | Financial Expertise | | Talent ManagementAudit |

Age: 5355 | | Business Operations/Strategic | | Information Technology/Cyber |

Board Committees: | | Planning | | |

| Audit | | Marketing/Public Relations | | |

| Compensation | | | | (Chair) |

| | | | | | | | | | | | | | | | | |

| DR. SYLVIA MAXFIELD, DEAN OF THE PROVIDENCE COLLEGE SCHOOL OF BUSINESS |

| Dr. Maxfield is Dean of the Providence College School of Business and was previously ChairmanChair of the Faculty and MBA Program Director at Simmons University in Boston. Additionally, she serves as voting member of the Rhode Island State Investment Commission, which oversees fund performance, including asset allocation and investment-related contracting. Dr. Maxfield also votes on shareholder proxy activity on behalf of the State. Previously, she has served on the boards of the Greater Providence Chamber of Commerce, Social Enterprise Greenhouse and the 21st Century Fund. Dr. Maxfield has been designated by the Board of Directors as a financial expert under the rules of the Securities and Exchange Commission. |

|

|

|

|

|

|

|

| Independent | Qualifications, Skills, and Experience:Board Committees: |

Years of Service: 24 | | Business Operations/Strategic | | Talent ManagementAudit (Chair) |

Age: 6365 | | Planning | | Corporate Responsibility/Governance/Nominating |

| Board Committees: | Financial Expertise/Literacy | | Community Leader |

| Audit (Chair) | | Marketing/PR | | |

| Corporate | | | | |

| Governance/Nominating | | | | |

| Risk Management, and Capital | | | | & Compliance |

16 BERKSHIRE HILLS BANCORP, INC. | 2022 Proxy Statement

PROPOSAL 1: ELECTION OF DIRECTORS |INFORMATION REGARDING DIRECTORS AND DIRECTOR NOMINEES

| | | | | | | | | | | | | | | | | |

| NITIN J. MHATRE, PRESIDENT, CHIEF EXECUTIVE OFFICER AND DIRECTOR OF THE COMPANY |

| Mr. Mhatre was appointed to joined the role of President andCompany as Chief Executive Officer of the Company and Chief Executive Officer of the Banka Director in January 2021. He was also appointed as a Director of the Company and the Bank. Prior to joining the Company, Mr. Mhatre waspreviously Executive Vice President, Community Banking at Webster Bank, where he was a member of Webster Bank's executive team and led consumerits Consumer and business banking businesses. BeforeBusiness Banking groups and Webster Investment Services. Prior to joining Webster, in 2009, Mr. Mhatrehe spent more than 13 years at Citi GroupCitigroup in various leadership roles across consumer-related businesses globally. Mr. Mhatre has served on the Board of the Consumer Bankers Association, headquartered in Washington D.C., since 2014 and was Chairman of the Board from 2019-20. He also serves on the Board of Cradles to Crayons Boston, based in Newton, Massachusetts.

|

|

|

|

|

|

|

|

| Non-Independent | | Qualifications, Skills, and Experience:

Years of Service: 13 | | | Public Company CEO | | Risk Management

Age: 5153 | | | Financial Institution Executive | | Regulated Industry

| | Business Operations/Strategic | | Corporate Responsibility/ |

| | | Planning | | Community Leader |

| | | Financial Expertise/Literacy | | Talent Management |

9 BERKSHIRE HILLS BANCORP, INC. | 2024 Proxy Statement

PROPOSAL 1: ELECTION OF DIRECTORS |INFORMATION REGARDING DIRECTORS AND DIRECTOR NOMINEES

| | | | | | | | | | | | | | | | | |

| LAURIE NORTON MOFFATT, DIRECTOR & CEO OF THE NORMAN ROCKWELL MUSEUM |

| Ms. Norton Moffatt is the Director and Chief Executive Officer of the Norman Rockwell Museum, Stockbridge, Massachusetts. Since 1986, Ms. Norton Moffatt has overseen the expansion of the museum’s facilities and the creation of a scholars’ research program. Her efforts resulted in the Museum receiving the National Humanities Medal, America’s highest humanities honor. Ms. Norton Moffatt is also an active community leader. She is a founder of 1Berkshire and Berkshire Creative Economy Council and serves as a trustee of Berkshire Health Systems and a director of Berkshire Health Systems, Inc. and Berkshire Medical Center, Inc.

|

|

|

|

|

|

|

|

| Independent | Qualifications, Skills, and Experience:Board Committees: |

Years of Service: 810 | | Business Operations/Strategic | | Marketing/PRCorporate Governance/Nominating |

Age: 6567 | | Planning | | Small Business Owner/Operator |

Board Committees: | | Financial Expertise/Literacy | | Corporate Responsibility/ |

| Corporate | | Talent Management | | Community Leader |

| Governance/ Nominating | | | | |

| Corporate Responsibility & | | | | |

| Culture (Chair) | | | | |

17 BERKSHIRE HILLS BANCORP, INC. | 2022 Proxy Statement

PROPOSAL 1: ELECTION OF DIRECTORS |INFORMATION REGARDING DIRECTORS AND DIRECTOR NOMINEES

| | | | | | | | | | | | | | | | | |

JONATHAN I. SHULMAN,KARYN POLITO, FORMER EVP AND TREASURER AT KEYCORPLIEUTENANT GOVERNOR OF MASSACHUSETTS |

| Ms. Polito is currently Principal of Polito Development Corporation, a commercial real estate development firm. Ms. Polito was the 72nd Lieutenant Governor of the Commonwealth of Massachusetts from 2015 to 2023. In that position, she advocated for women’s empowerment and championed renewable energy, climate adaption, workforce development, affordable housing, and the innovation economy. She helped increase aid to local communities and spearheaded efforts to expand offshore wind and educational opportunities for careers in science, technology, engineering and math for women and students. Prior to serving as Lieutenant Governor, Ms. Polito was a member of the Massachusetts House of Representatives and a Partner at Milton, Laurence & Dixon, LLP. |

|

|

|

|

|

|

|

| Independent | Board Committees: |

| Years of Service: 1 | | Corporate Responsibility & Culture |

| Age: 57 | | Risk Management, Capital & Compliance |

| | | | | | | | | | | | | | | | | |

| ERIC S. ROSENGREN, FORMER PRESIDENT AND CEO OF THE FEDERAL RESERVE BANK OF BOSTON |

| Mr. ShulmanRosengren is CEO of Rosengren Consulting and Visiting Scholar at the MIT Golub Center for Finance and Policy. He previously served as President and CEO of the Federal Reserve Bank of Boston from 2007 to his retirement in 2021. As a Federal Reserve Bank president, he was formerly Executive Vice President & Treasurer at KeyCorp, a publicly traded U.S. bank.participant and voting member of the Federal Open Market Committee. He also led projects to help rebuild smaller city economies and provide opportunities for diverse populations to prosper. Mr. Shulman possesses deep commercialRosengren joined the Boston Fed in 1985 and held various roles in the Bank’s Research and Supervision, Regulation, and Credit Departments. He has published numerous papers and articles, and is often cited in leading academic journals and is featured in major media on topics including macroeconomics, monetary policy, international banking, experience that includes financial markets, governance, and balance sheetbank supervision, and risk management disciplines. He began his career with KeyCorp in 1989 and served in leadership roles in financial market strategy, asset liability management, wholesale funding and capital planning. Shulman has also held committee membership positions on KeyCorp’s Asset Liability Committee, Market Risk Committee, Model Risk Committee, and Funds Transfer Pricing Committee.management. Mr. ShulmanRosengren has been designated by the Board of Directors as a financial expert under the rules of the Securities and Exchange Commission.

SEC rules.

|

|

|

|

|

|

|

|

| Independent | Qualifications, Skills, and Experience: |

Years of Service: 2 | | Financial Institution Executive | | Risk Management |

Age: 59 | | Business Operations/Strategic | | Regulated Industry |

| Board Committees: | | Planning | | |

| Audit | | Financial Expertise/Literacy | | |

| Risk Management and Capital | | | | |

| Compliance and Regulatory | | | | |

| (Chair) | | | | |

| | | | | | | | | | | | | | | | | |

MICHAEL A. ZAITZEFF, MANAGING MEMBER OF VM GP II LLC |

| Mr. Zaitzeff is a co-founder and managing member of VM GP II LLC, the general partner of HoldCo Asset Management, LP. Mr. Zaitzeff has served as a member of numerous corporate boards, oversight committees and creditor committees. Mr. Zaitzeff served on the Trust Advisory Board of WMI Liquidating Trust, a trust created to implement the Chapter 11 Bankruptcy Plan of Washington Mutual, Inc.

|

|

|

|

|

|

|

|

Independent | Qualifications, Skills, and Experience: |

| Years of Service: 1 | | Financial Expertise/Literacy | | Marketing/PRAudit |

Age: 3966 | | Regulated Industry | | Small Business Owner/Operator |

Board Committees(1):

| | | | |

| Audit | | | | |

| Risk Management, and Capital | | | | & Compliance (Chair) |

(1) Pursuant to the Company’s Cooperation Agreement with HoldCo Asset Management, LP, Mr. Zaitzeff was appointed to the Audit Committee and the Risk Management and Capital Committee, and serves as a non-voting observer on the Corporate Governance/Nomination Committee.

1810 BERKSHIRE HILLS BANCORP, INC. | 20222024 Proxy Statement

PROPOSAL 1: ELECTION OF DIRECTORS |INFORMATION REGARDING DIRECTORS AND DIRECTOR NOMINEES

Information About Director Nominees

•73% of our director nominees are female and/or racially or ethnically diverse.

•40% of our Board committees are chaired by diverse directors.

11 BERKSHIRE HILLS BANCORP, INC. | 2024 Proxy Statement

PROPOSAL 1: ELECTION OF DIRECTORS |CORPORATE GOVERNANCE

Corporate Governance

The Company is committed to strong corporate governance policies, practices, and procedures designed to make the Board more effective in exercising its oversight role. The following sections provide an overview of our corporate governance structure, including independence and other criteria we use in selecting director nominees, our Board leadership structure, and the responsibilities of the Board and each of its Committees. Our Corporate Governance Policy, among other key governance materials, helps guide our Board and management in the performance of their duties and is regularly reviewed by the Board.

| | | | | | | | |

| Key Corporate Governance Documents |

Please visit our investor relations website at ir.berkshirebank.com to view the following documents: |

| | Corporate Governance Policy |

| | Code of Business Conduct |

| | Anonymous (Whistleblower) Reporting Line Policy |

| | Board Committee Charters |

| | Certificate of Incorporation |

| | Company By-Laws |

These documents are available free of charge on our website or by writing to Berkshire Hills Bancorp, c/o Wm. Gordon Prescott, Senior Executive Vice President, General Counsel and Corporate Secretary, 60 State Street, Boston, Massachusetts 02109. |

|

The Board and management regularly review best practices in corporate governance and are committed to a program that serves the long-term interests of our shareholders. We believe good governance strengthens accountability and promotes responsible corporate citizenship. Several of our current best practices are highlighted below:

| | | | | | | | |

| Independent Oversight | Shareholder Orientation and Accountability | Good Governance |

Majority independent directors(1) | Declassified Board with all directors standing for election each year | Diverse board membership (skills, tenure, age); annual director education; active board replenishment program |

| Strong and engaged independent Board Chair | Robust stock-ownership guidelines | Annual evaluation of CEO and senior management and review of succession plans |

| All key committees are fully independent and led by the Board chair | Annual shareholder engagement program | Implementation of a Corporate Responsibility & Culture Committee at both Board and employee level |

| Regular executive sessions of independent directors | Plurality voting standard for director elections, with director resignation policy in effect for uncontested elections | Risk oversight by full board and committees |

| Board Chair or Chair of Corporate Governance can call special meeting of the Board at any time for any reason | No poison pill in place; annual election of all directors | Formal ethics code, reporting hotline and ethics training to all employees |

(1)1110 out of 1211 of the director nominees will be designated as independent directors; CEO/Director Mhatre is not independent.

1912 BERKSHIRE HILLS BANCORP, INC. | 20222024 Proxy Statement

PROPOSAL 1: ELECTION OF DIRECTORS |CORPORATE GOVERNANCE

Board of Directors

The primary functions of Berkshire’s Board of Directors are:

•To oversee management performance on behalf of shareholders;

•To ensure that the interests of the shareholders are being served;

•To monitor adherence to Berkshire’s standards and policies;

•To promote the exercise of responsible corporate citizenship; and

•To perform the duties and responsibilities assigned to the Board by the laws of Delaware, Berkshire’s state of incorporation.

Customarily, the Board elects its members to serve in identical capacities on the Board of Directors of Berkshire Bank, the Company's main operating subsidiary which is chartered in the Commonwealth of Massachusetts.

Talent Development and Succession Planning

One of the Board's primary responsibilities is to oversee the development and retention of key talent within the Company and to ensure that an appropriate succession plan is in place for our Chief Executive Officer and other senior executives. The Board meets regularly with senior management and periodically reviews the readiness of key employees to potentially assume additional roles and responsibilities, including in the event of unexpected circumstances. In addition, our Chief Executive Officer regularly discusses with our Corporate Governance/Nominating Committee recommendations and evaluations as to potential successors for senior positions. The Committee incorporates this feedback into its leadership development and contingency plans. While the Corporate Governance/Nominating Committee has primary responsibility for developing and maintaining a succession plan, the Committee regularly reports to the Board on this matter, and final decisions on senior leadership succession matters, other than the CEO, are made by the CEO in consultation with the full Board. The successful management of executive succession in 2021 was accomplished within the framework discussed above.

Identification of Candidates and Diversity

The Corporate Governance/Nominating Committee regularly reviews the composition of our Board and, as appropriate, recommends steps to be taken to ensure that the Board reflects the desired balance of skills, experience and diversity and meets the requirements of all applicable laws and regulations.

The Board maintains an ongoing refreshment program to identify highly qualified candidates that are aligned with our long-term strategy. Our corporate governance guidelines provide age and tenure limits, of 75 and 12 years respectively, to facilitate appropriate transition and renewal. In accordance with our Corporate Governance Policy, the Corporate Governance/Nominating Committee and Board shall take into account diversity considerations. Diversity is broadly construed to mean not only diversity of gender, race, ethnicity and sexual orientation, but also diversity with respect to personal and professional experiences, backgrounds, opinions, beliefs, education and perspectives.

The Corporate Governance/Nominating Committee is committed to fostering an environment of diversity and inclusion, including among our directors, and is tasked as part of its annual evaluation with determining whether or not the Board is appropriately diverse. The Corporate Governance/Nominating Committee’s continued commitment to diversity is evidenced by the following:

•58% of our director nominees are female and/or racially or ethnically diverse;

•Half of our Board committees are chaired by diverse directors.

20 BERKSHIRE HILLS BANCORP, INC. | 2022 Proxy Statement

PROPOSAL 1: ELECTION OF DIRECTORS |CORPORATE GOVERNANCE

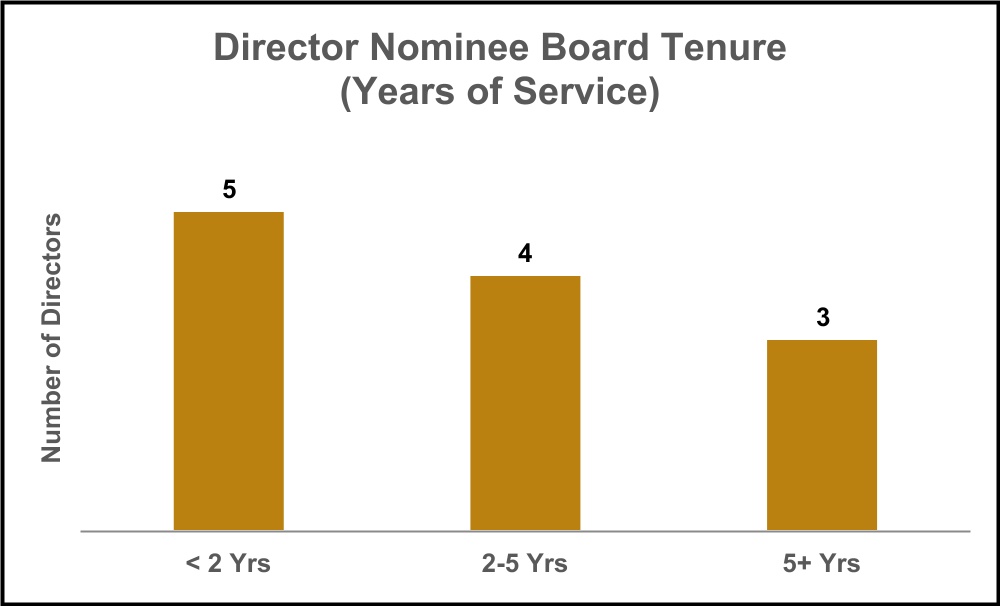

Ongoing Board Refreshment

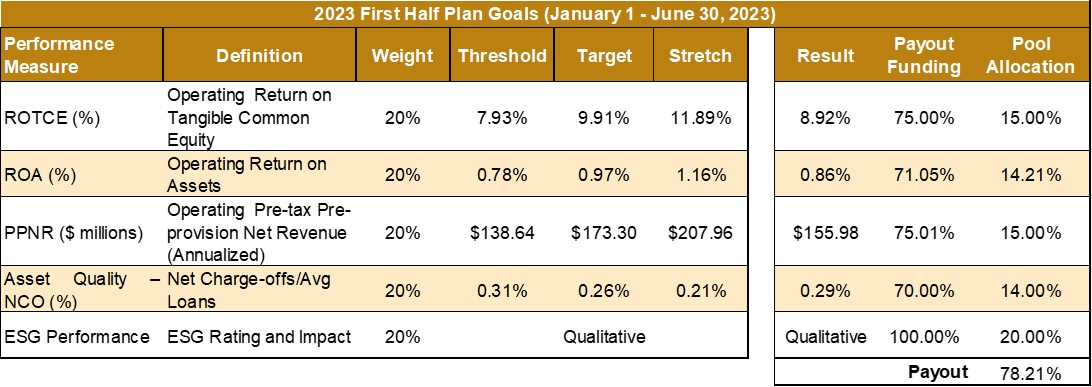

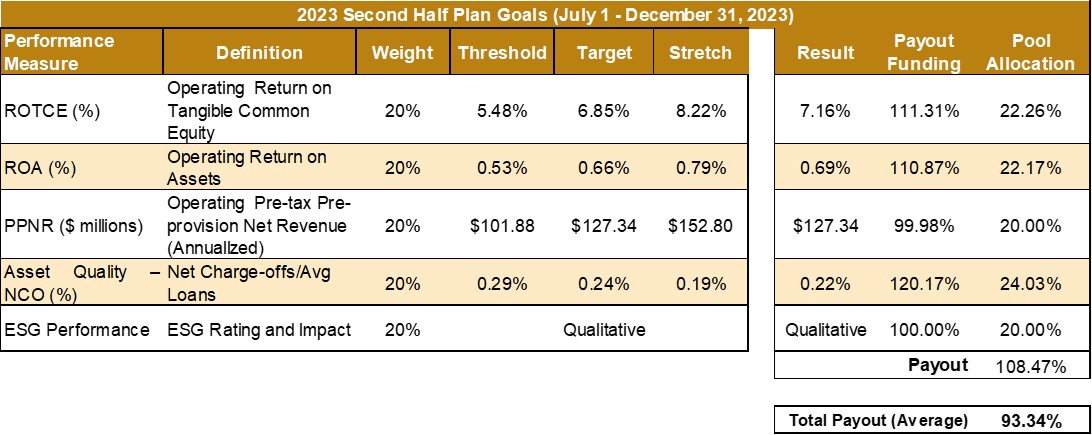

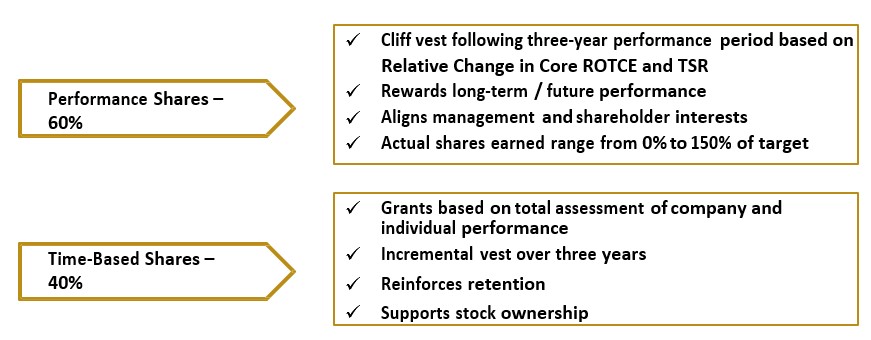

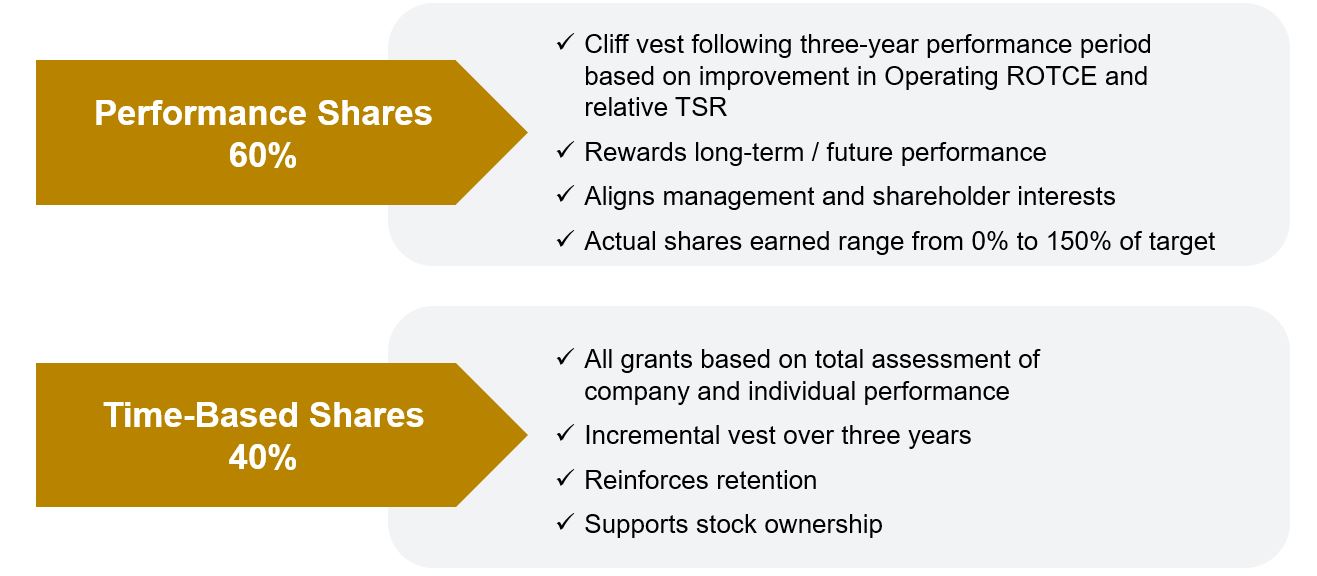

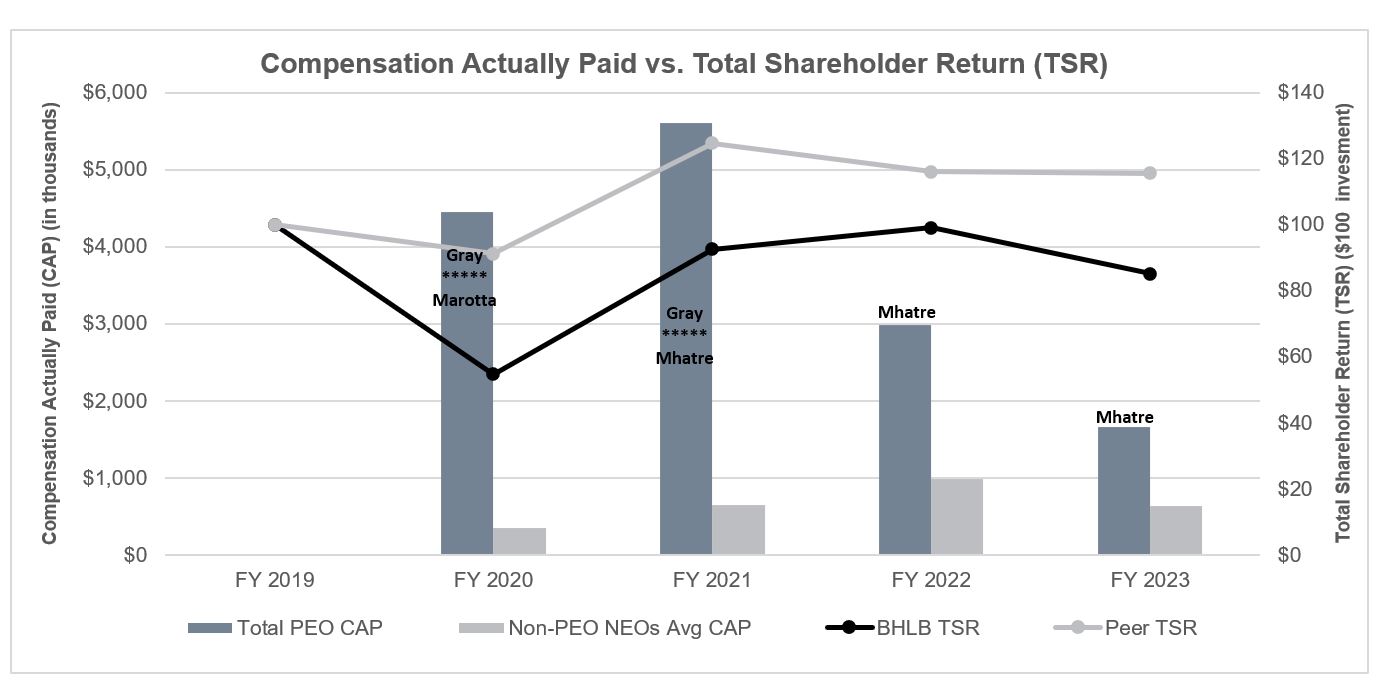

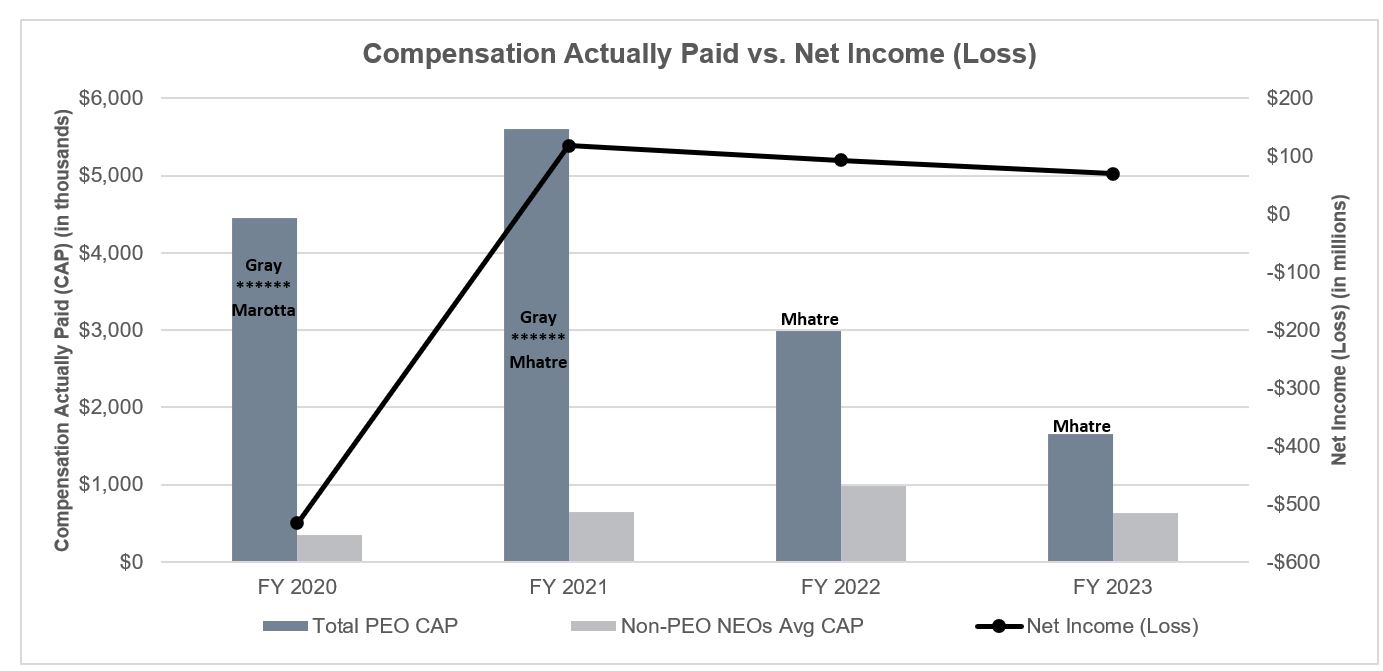

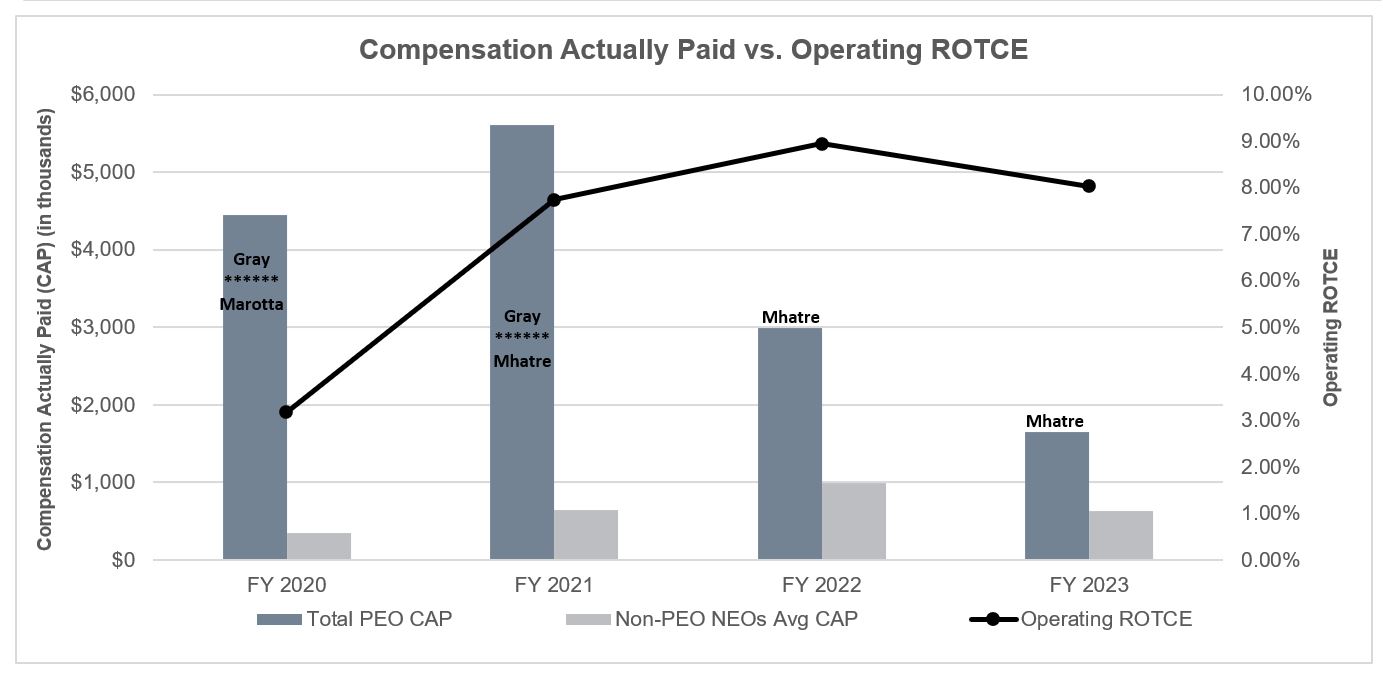

We believe that the Company benefits when the Board is comprised of a mix of experienced directors with diverse and fresh perspectives. To that end, the Board maintains an ongoing refreshment program to seek out highly qualified candidates with skills and experiences that are aligned with our long-term strategy. We have also adopted corporate governance guidelines providing both age and tenure limits, of 75 and 12 years, respectively, to facilitate appropriate transition and renewal. These guidelines as well as the Board’s general commitment to thoughtful refreshment has resulted in a number of changes in recent years.